An Assault on the Senses

Before we start running through some smart shopping strategies, here’s a look at the physical experience of visiting the supermarket and how it leads to us handing over more of our cash.

Smell: They say you should never do a food shop whilst you’re hungry. Everything will seem more appealing and you’ll buy up all sorts of things that you don’t need based on a temporary sensation. Unfortunately, supermarkets actually attempt to make us feel hungrier than we are by pumping the smell of freshly baked bread throughout the place.

Sight: The products at eye level on the shelf are those with the highest mark up. If you want to save you’ll literally need to stoop to find lower priced alternatives.

Space: The most commonly bought items are spaced apart to ensure that you cover as much ground as possible with each trip. This isn’t done in an attempt to keep you nice and lean. It’s to make sure you walk past as much tempting produce as possible.

These little tricks are widely known about, and yet they still work. That’s testament to just how effective they are. You need to keep them in the forefront of your mind when doing your shop to avoid being duped into spending over the odds. One good way of combating the ingenious layout of a store is to have a list and not only stick to it, but navigate the store according to it, keeping away from anything you don’t want to buy. This will help take temptation out of the picture.

The Psychology of Anti-Branding

We’re all aware that brands spend big to burrow themselves into our consciousness. Most of us also realise that supermarkets stand to make more from selling their expensive ranges than they do from pedalling their basic products. But have you stopped to consider how this affects the way supermarkets will sell certain items?

They know that you have a choice for any product you might be looking at. There will be the big brand name, with its iconic logo, there will be the seller’s own brand which will pitch itself as cheap and cheerful knock off of the more famous brand name version, and then there will be the ‘basic’ version. The packaging for this will be downright stark. It may even be completely plain, but for a label saying what it is and listing the ingredients in an unfriendly looking font.

It’d be natural to assume that, seeing as this product is the most basic, it has stark packaging because they didn’t want to spend money on making it look good. In reality the opposite is true. The packaging has been cleverly and very deliberately designed to look as unappetising as possible. It sounds mad but it’s true. They are deliberately making their product look bad so as to make you feel like you’re better off going for a more pricey option. You might think, well if they couldn’t be bothered to put any effort into the packaging then the stuff inside can’t be too good. They’re trying to enforce the perception that the only way to get good quality produce is to pay more.

Of course, it would be naive to ignore the cynical use of social stigma behind their tactics. We can all admit that we get a bit squeamish about having our finances broadcast far and wide. By making the cheapest products look so different from the rest, they are trying to embarrass us into avoiding them as choosing them will make it obvious to everyone around us, or who comes to visit our homes, that we are trying to save. They know people feel awkward about these things and they seek to capitalise on it.

At the end of the day, it’s just a number of illusions working in tandem. First there is the illusion that the stuff in the different boxes varies greatly in quality. In most cases the difference will be negligible. The second is the illusion that the different products are all being marketed by people competing and doing their best to win you over. That isn’t the case. The marketing strategies work together to make sure the most expensive looks the most attractive. Always remember that just as much cunning (if not money) has gone into the packaging of the ‘basic’ or ‘economy’ item as the ‘own brand’ one that attempts to look like the yet more expensive brand name option.

Of course, it should be said that part of the reason for making ‘basic’ products look the way they do is to help make them obvious to people who can’t afford anything else. At the same time though, it seems the supermarkets are keen not to have those who can afford ‘better’ saving their pennies by grabbing them as well.

Try out cheaper items and see if you can actually tell any different. Chances are you won’t be able to. Indeed, many taste tests have shown people to prefer cheaper options to their posher counterparts. Of course, if a genuine offer makes a brand name cheaper, go for it.

Be Aware of Your Spending

As the things we buy from the supermarkets are the day to day things we can’t do without, we don’t really have the option of not buying them. This can lead us to get a bit lazy when it comes to monitoring our spending. If we think of our weekly shop in its entirety as being an unavoidable expense then we’ll fail to see ways we can save.

Remember, to keep your receipts and compare what you’ve saved if you switch to cheaper options or manage to eliminate unnecessary items. This is a great way to keep on the ball with regards to spending.

Beware ‘Special’ Offers

Of course, you’ll occasionally see comical instances where a retailer makes a multi-buy offer that is actually more expensive than buying the products individually (it’s unclear whether these are just innocent mistakes or a way of targeting people with poor numeracy skills) but even offers that do appear to make sense might not really be all that great.

It’s been found to be common practice for supermarkets to sell an item for a very short time at an inflated price, simply so they can then offer it at a ‘reduced’ price later. To a customer, this will feel like great savings are being made. The reality is, you’re simply paying a fair price. The previous price was far too high.

The lesson is simply to look at the bottom line. Is there a cheaper alternative to what you’re buying? Whether it’s on offer or not isn’t really relevant to how much you’re spending.

If you want to see some really good special prices, often the best deals in the whole store are the individually reduced items. If you go shopping later in the day, at between 7pm-10pm you’ll see items knocked down by 75% or more.

The other area where it’s good to take advantage of offers is non-perishable goods, as you don’t have to worry about using them within a certain time frame.

Grab Some Online Vouchers

It won’t take you an awful lot of effort to find a load of places where you can avail yourself of coupons that’ll knock down the rice of your shopping. Just be aware that often the idea behind these promotions is simply to get you in the door in the hope you’ll splurge once you’re there. This can actually work quite well as the customer already has their coupon, and therefore feels they’ve made some savings. This could make it more tempting to indulge in some pricey treats.

Take Them Up On Their Promise

Lots of supermarkets have price match promises, but not many people can be bothered to take up the mantle and actually put them to the test. However, it’s not all that hard. Asda for instance will refund you the difference if your shopping would have cost less at Tesco, Sainsburys, Morrison or Tescos. All you need to is go online and enter in the code from your receipt. They’ll even give a refund if their competitors would’ve come within 10% of theirs. Tesco and Sainsbury’s both purport to offer automatic refunds where they’re more expensive.

Don’t Be a Waster

Never throw away food based on its display until date. That doesn’t concern you. It’s for the staff. Food will still be fine to eat after this time. It’s also important to understand that a best before date is, as its name suggests, simply date before which a product is at optimal quality. This doesn’t necessarily mean there is any risk in consuming it after this time. It just implies that, in the manufacturer’s opinion that the flavour and texture might not quite be what they were.

The use by date is the only one that should be prompting you to throw anything away. With a little bit of forward planning you should be able to think of ways to use your ingredients before this happens.

Think About Leaving the Kids at Home

The supermarket won’t give up trying to wrest a little more from you until you’re completely out of their grasp. Even when you make it to the checkout queue and are waiting to pay, you’ll be bombarded with one last array of expensive treats. These are especially alluring for children, and even if you can resist your own sweet tooth, you may have your willpower broken by the pleading of your little ones.

Indeed, this ‘nag factor‘ (the ability of a product to get children to harass their parents into throwing their money at it) will follow you all round the store. If you’ve ever been shopping with a child you’ve probably had them try and slyly smuggle something into your trolley undetected. To be fair, if you’ve ever been a child you’ve probably tried to smuggle something into a parent’s shopping trolley undetected.

With that in mind, though it may sound cold, it’s a pretty good idea to leave the kid’s at home if possible. That way there’ll be no tantrums.

]]>

You may have heard it said that, in life, you only get out what you put in. It is a nice thought but, if this were strictly true, it would be completely impossible for businesses to operate!

After all, businesses only exist in order to make profit, and profit depends on getting out more than you put in…

This is where ‘return on investment’ (ROI for short) comes in.

What is ROI?

‘Return on investment’ is a simple measure of how much you might expect to get back from any particular investment. ROI will basically tell you how much you will get out, when compared to how much you put in, expressed as a percentage.

You can calculate ROI using the following equation;

| ROI = | (Revenue from Investment – Cost of Investment) |

| Cost of Investment |

To get the ROI as a percentage, you would take the answer this equation gave you and multiply it by 100.

For example, if after doing the division part of the equation, you ended up with the answer 2, the ROI as a percentage would be 200%.

Confused? To make things clearer, here are some examples of what various ROI percentages mean in real terms.

-100% = You’ve lost all the money you put in.

-50% = You’ve lost half the money you put in.

0% = You’ve broken even. (Nothing lost, nothing gained.)

50% = You’ve got back what you put in, plus another 50% of that amount as profit.

100% = You’ve doubled your money!

Now, let’s take a look at a basic business example and see how this formula would apply.

Say some children wish to set up a lemonade stand on their street. They spend £5 of their pocket money on lemons, sugar and all the other ingredients that they need.

They have enough to make 20 cups of lemonade. They charge 50p a cup and manage to sell them all. At the end of the day they would have £10 in their till.

Their ROI formula would look like this;

| ROI = | (£10 – £5) | = 1 x 100% = 100% |

| £5 |

As we know, an ROI of 100% means they doubled their money, making lemonade look like a pretty good investment!

Of course, this example ignores the cost of their labour and time, but for big businesses (and your personal finances) these things are very important.

How Do Businesses use ROI?

Obviously, having a high ROI relative to your competitors is vital to running a successful business. Big businesses take a great deal of care in deciding how best to spend their money and they will attempt to calculate as accurately as possible the ROI of all the money they spend, from the wages they pay employees, to the their advertising budget.

In fact, businesses are so obsessed with ROI, some will even calculate the return on investment they get from spending money and time on calculating ROI itself!

The reason they go to such lengths is to ensure that their money is put to the best possible use i.e. the use that will yield the biggest return on investment in the end.

Sometimes this will involve doing something that at the time may seem a bit outlandish, but is justified by the eventual ROI.

In our article on opportunity cost we talked at length about the ‘time value of money’ and this is a big factor in figuring out ROI.

For example, when firms first splash out on TV advertising, it costs a very large sum of money. This is eventually made back, as their brand gets a bigger profile and they win more custom (assuming the advert isn’t a flop) but it takes time.

Another example might be the emergence of a new technology. Businesses will scramble to snap it up, not because of what it is worth now, but because of what it might be worth in the future.

The key to spending wisely is figuring out the eventual ROI of your investment, rather than merely looking at the cost. If the ROI is great (and you can be sure the projected ROI is correct), the cost is almost irrelevant (assuming available funds).

How Can I use These Ideas to Improve My Personal Finances?

Like a businesses, you to can make wise spending decisions by attempting to calculate the ROI they are likely to generate.

Of course, there are big differences between the way individuals and businesses spend their money.

A business only ever spends money on anything because it hopes to make more money further down the line. As cynical as it sounds, even when a businesses makes a charitable donation it will have most likely have one eye on the ROI that the positive publicity will create, not to mention the tax savings!

Unlike a business, people generally buy things simply because they want them, not because they will make us better off in the future. If anything we fully expect most of our purchases to make us worse off financially. In this case, we think of the ROI simply as the pleasure we’ll get from buying whatever it is we have our eye on.

That said, there are plenty of ways we can think like a business, spending money in order to make money.

Just as a business has assets, so do individuals. In most cases a person’s biggest asset will be their property.

It is possible to add value to assets by investing in them and there are a wide range of things you can do to increase the market value of a house, from something as simple as a quick paint job, to something as extensive as having an extension built. As these things add value, they bring a return on investment.

Smart people realise that, whilst it is important to consider the cost involved when undertaking such a project, ROI is the real measure of how best to spend money.

For example, you might spend £5,000 on double glazing, adding £10,000 to the value of your house. The ROI in this case would be as follows;

| ROI = | (£10,000 – £5,000) | = 1 x 100% = 100% |

| £5,000 |

You’ve doubled your money, not bad going…

However if you spend £10,000 converting your loft into a new bedroom, this might add £30,000 to the value of the house. Thus, the ROI is as follows;

| ROI = | (£30,000 – £10,000) | = 2 x 100% = 200% |

| £10,000 |

An ROI of 200% means you’ve tripled your money!

Though our ‘common sense’ tells us that the £10,000 investment is the bigger, more risky investment, a look at the ROI tells us that this is not the case.

The bigger the ROI the more value you get, pound for pound. So, though the double glazing seems the cheaper option of the two, you pay more dearly for every pound of value it adds to you home than you do with the loft conversion. It is, therefore, relatively speaking, a more expensive way of adding value.

Obviously, you need to have dependable figures to calculate ROI in the first place, but in the examples given above these can normally be found quite easily.

The other key thing to remember when calculating ROI is the time frame involved. There is no point working out how much your new energy efficient car will save you over the course of ten years if you replace it after just two!

]]>

Game theory is used to by mathematicians to calculate the best course of action to take in various strategic situations. At its most complex game theory can be used, not only by businesses and economists, but also social scientists, psychologists, philosophers and biologists. At its simplest, it’s something we can all make use of in our everyday lives.

What Is Game Theory?

Whilst game theory has many different forms depending on the situation it is applied to, it is easiest to explain by giving a basic example of how it works, such as the well known prisoner’s dilemma;

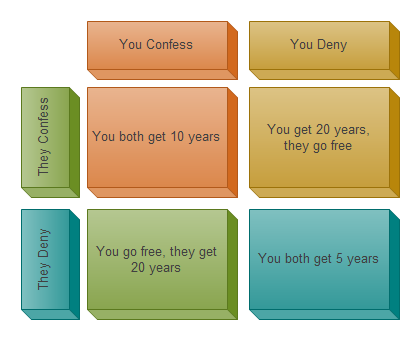

Imagine that you and a friend have been arrested by the police force of a corrupt government, accused of a joint crime. They are assuming that you are guilty and there will be no trial. Instead, they offer you two options; deny the charges or confess to them.

The possible outcomes of your decision are;

- If you both confess, you’ll both get 10 years in jail.

- If you confess the charges and your friend denies them, he’ll get a full 20 years, but you’ll be rewarded for exposing him by going free (and vice versa.)

- If, even in the face of this offer, you still both deny the charges, they will entertain the idea that you are innocent after all and only give you five years each, just in case.

You are held in separate cells and can’t communicate.

The situation and its possible outcomes can be expressed in a matrix like this;

If you think they will deny, it is best to confess. That way you go free instead of getting 5 years for denying it along with them.

However, even if you think they will confess, it is still better for you to confess as well. That way you’ll only get 10 years, avoiding the 20 years you’d get if you choose to deny the charge.

As, no matter what the other person does, it is better for you to confess, confession is what’s called the ‘dominant’ strategy.

So, with that in mind maybe it’s not a dilemma at all? Surely it is best just to confess, isn’t it?

Nash Equilibrium

This situation is what’s called a ‘Nash equilibrium’ (named after the pioneering mathematician John Nash, played by Russell Crowe in the film ‘A Beautiful Mind’).

In a ‘Nash equilibrium’ one person looks at what the other might do and decides that, as they can’t tell what their choice will be, they have to stick with the option that is safest in all cases. They have to go for the ‘dominant’ strategy. This applies to both prisoners, hence the state of equilibrium.

But is this actually what’s best for the people involved? No, it isn’t!

Why? Look again at the prisoner’s dilemma example above. Because both prisoners will reach that same conclusion that confession is the ‘dominant strategy’ both will confess. That means they both get 10 years in jail.

However, if they both deny they only get 5 years! This is the option that involves the least combined jail time. On top of that the jail time is split fairly between both parties. This makes it what’s called the ‘optimum outcome’. In other words, it’s the best thing that could happen, overall.

But can you trust your partner to figure this out? If you deny and they still confess you’re looking at 20 years!

In real life people, especially when it comes to businesses, tend to see others as competition rather than partners. Therefore, they go for the safe option i.e. the dominant strategy.

The real lesson of ‘Nash equilibrium’ is that, due to not cooperating properly people and businesses usually miss out on the ‘optimum outcome’ because they are scared of straying from the ‘dominant’ option, which guards against the unpredictability of others.

Basically, we could all be better off if we all worked together, but in business that isn’t how it works.

How Do Businesses Use Game Theory?

The way that businesses decide on their pricing structures is very similar to the logic of the prisoner’s dilemma.

When a business sets a pricing strategy it has two basic options;

- Charge as much as possible, making maximum profit from each sale.

- Charge as little as possible, keeping prices down and driving up demand.

These are the two extremes of the scale and all pricing strategies fall between these two poles. But if this is the case, why do similar products generally cost more or less the same? Why don’t we see a wider variety of pricing structures used?

The answer lies with the Nash Equilibrium.

In our earlier example we saw that if each prisoner denied the charge it would produce the ‘optimum outcome’ but that they would also run the risk of going down for 20 years if their partner confessed.

For two similar competing businesses the optimum outcome would be if they both set high prices, as they would make high profits on each sale and, as customers would have little reason to pick one over the other, prices being the same, they would likely have an equal market share.

However, if one business sets its prices at an artificially high level, they have no guarantee that other businesses will do the same. They run the risk of competitors undercutting them.

Should this happen the business with the lower price will take a huge chunk of the market share, as customers will choose the cheaper option. The firm with lower prices will prosper and the firm with high prices will be ruined.

By this logic, if one firm finds itself in a position where it can offer extremely low prices, all the other firms are forced to lower theirs as well, to avoid losing custom. This will eat into their profits and make all the businesses worse off.

(Some businesses have even used this as a tactic to ruin their competition. Some big chain stores have been known to move into an area, lower prices to the point that they are making a negative ROI, forcing others to do the same. The local businesses can only survive making a loss for a while, but the chain store can go on, as it is supported by the profits from other branches. Once all the local competition has been eliminated the chain store puts up its prices, knowing customers have no choices left!)

As a result, competing businesses are held in a sort of ‘Nash equilibrium’ when it comes to pricing, going for a competitive price to avoid being undercut, but also trying to avoid triggering a ‘race to the bottom’ that makes everyone worse off. This is good news for customers as it means they usually get a decent deal.

If the businesses were to get together and cooperate to keep prices high it would be very harmful to consumers. Some businesses attempt to do this, forming cartels and making agreements with each other. In most countries and in most industries this practice of ‘price fixing’ is illegal.

In the same way that the prisoners were held in separate cells to stop them cooperating with each other, government’s encourage businesses to be competitive so that they will not indulge in price fixing.

How Can I use These Ideas to Improve My Personal Finances?

There are a number of ways you can use a good knowledge of game theory to improve your finances. For one thing, simply being aware of how ‘Nash equilibrium’ should keep prices low will help you spot when businesses are not behaving in a competitive manner and avoid getting ripped off.

Sometimes you can even use game theory to save money by forcing businesses into a sort of prisoner’s dilemma which will make them more competitive and thus lower their prices.

For example, one leading thinker in the area of game theory uses this technique whenever he buys a car;

In the morning he will phone every dealership within easy travelling distance of his home. He tells them all the same thing; that he has decided that he will definitely be buying X car that day at 5pm. He will turn up with a cheque at whichever dealership phones back with the best offer in the mean time.

In doing so, he creates a sort of reverse bidding war. As we’ve seen it would be best for all the dealerships involved if they all ignored him, as they wouldn’t have to lower their price. But by now we know that businesses rarely go for the ‘optimum outcome’. Instead, they’ll go for the ‘dominant strategy’ and lower their price to avoid losing an easy sale, assuming the other show rooms are doing the same thing. The gentleman in question claims to have thousands using this method.

Of course sometimes, even though you are a private individual rather than a business you yourself may have to use game theory in an uncooperative manner, for the sake of your personal finances.

For example, if you are bidding on a house game theory can be very useful in helping you decide how much you’d like to bid. If you are competing with another person to get the house the ‘optimum outcome’ as far as you’re concerned would be if you both put in low bids. One of you is going to win the house anyway, so why go crazy?

However, you aren’t going to be discussing your bids with the other interested party (you probably won’t know who they are) and you have to assume that if you go with a low bid they might outbid you. By the same token, if you are desperate to avoid being outbid and put in a higher offer, you may end up paying several thousand pounds more than need be.

In this case you will both go for the middle path, trying to avoid being outbid on the one hand, and paying more than need be on the other. This is the best that you can do, given what others may be doing. In other words, it is the ‘dominant strategy’.

This is especially true if you are buying a house in Scotland, as you will normally make a sealed bid for it. In this case you only get one chance to make a choice on how much to offer and you have no way of knowing what the other interested parties might do. This makes it highly analogous with the prisoner’s dilemma we have been looking at.

In England houses are sold in a slightly different style similar to that of an traditional English auction, where even if the other bidder out bids you, the auctioneer will come back to you and give you the chance to put in a higher offer.

In this instance, the fact that you will get multiple chances to bid and the fact that you will be aware of what your fellow bidders are doing means that it may be easier for you to co-operate and reach an ‘optimum outcome’ by only increasing your bids by a small amount each time.

You can also use you knowledge of game theory to undo the ‘Nash equilibrium’ in situations where you and your friends are going for a ‘dominant strategy’ when you could get an ‘optimum outcome’ instead.

When you think about it, there are a lot of situations that may arise in your social life that are similar to the prisoner’s dilemma.

For example, when you and a group of friends are going out to a social event you, like a business, have to pick a sort of pricing strategy. Do you go somewhere expensive, that will be a really great experience, but maybe a bit expensive for some people in the group, or do you go somewhere that everyone can easily afford, but maybe be less enjoyable?

As people are often embarrassed in discussing matters of personal finance they go for what appears to be the ‘dominant option’ of picking something that is a slight strain on their finances, but that they think everybody else will want to do.

However, unlike businesses and prisoners, there are no rules to stop you and your friends communicating with each other to discover the optimum solution. You may all be worried about suggesting somewhere cheap and risking embarrassment, but if you come out and say it you’ll probably find everyone was thinking the same thing, they just didn’t say so based on what that thought the rest of the group would want. In other words, they were stuck in an unhelpful ‘Nash equilibrium’.

If you know your stuff you can avoid such situations!

]]>

Opportunity costs apply to every single financial decision we ever make, yet very few of us understand the concept well enough to make the most of our cash. However, as always, some valuable lessons can be gleaned from a look at the way big businesses operate.

What is an ‘Opportunity Cost’

Very simply, an ‘opportunity cost’ is what you miss out on when you choose to do one thing over another. For example, if you spend £20 on a night out, you miss out on the benefit of putting that £20 into a savings account.

So, whenever you buy a product or a service you are in fact faced with two costs; the price of the product/service and the ‘opportunity cost’ of not being able to use that money for anything else.

How Do Businesses Use Opportunity Cost?

Businesses (successful ones at least!) always attempt to plan as far ahead as possible. They use the idea of opportunity cost to help them decide how to spend their money in the way that will be most beneficial to the business in the long term. They do this by thinking about the ongoing consequences of their opportunity costs.

For example, a relatively new independent clothing shop, which has gained popularity and started to turn a profit may need to decide if is going to invest that profit in spending on advertising to drive up demand, or in a new member of staff, to deal with their current demand better.

They can only pick one, but they need to consider the ongoing consequences carefully. For example, spending more on advertising, driving up demand and making more profit sounds great, but the opportunity cost of not hiring a new employee may mean that the shop is under staffed.

If the business can’t cope with the higher demand, it may lead to a worse service and a worse reputation. Not a good result considering that the company choose to spend their money on spreading their name!

Just as the cost of hiring an employee would be ongoing, the cost of being constantly understaffed is also ongoing. In fact, it is likely to get worse as time goes on. So, although a lot of the time weighing up opportunity costs will lead a business to spend money on whatever is most urgently needed (just as a individual would), businesses are usually a lot better at judging how the opportunity cost of a decision may change over time.

Furthermore businesses understand that, in the same way the opportunity cost of a financial decision can change over a period of time, so can the value of the money involved.

The Time Value of Money

When calculating opportunity costs businesses will always consider ‘the time value’ of the money involved, something many of us wouldn’t think to do for one simple reason; we don’t know what the ‘time value’ of money is!

Thankfully, this idea is also simple. If you put £100 in a savings account at 5% interest per annum, in one year you’ll have £105. So, if you spend £100, the opportunity cost is not limited merely not having £100 anymore, it also includes missing out on the £105 ‘future value’ of the money.

As businesses are always looking for a good return on investment, they expect any money they spend to make more money for them in the future. Sadly, this is the opposite of the way we consumers tend to think about our own spending.

How Can I Use These Ideas to Improve My Personal Finances?

In practical terms we are all aware of how opportunity costs work. Even the child in the sweet shop is aware of the opportunity cost involved in including a heavy piece of fudge in his bag of pick and mix, rather than several light marshmallows.

Weighing up the opportunity cost of your day to day spending is obviously a good way of stopping your wages being drained away by unwise purchases. If you constantly have an eye on the alternatives, you’ll be less likely to be seduced by any old offer put in front of you.

However, when we look at the way businesses operate we realise that the real value of understanding opportunity costs lies in the way it will help you look ahead when making a long term financial decision.

For example, if you were going to spend £10,000 on a car, at first it would appear that the opportunity cost of such a decision would be no longer having that £10,000 available to spend on other things. But, if you think like a business, you’ll take both the ongoing nature of opportunity costs, as well the time value of money, into account. When you do this, you soon realise that, if you take a longer view, perhaps three years or so, the opportunity cost is quite different.

That £10,000 could have been placed in a high interest savings account earning 7% per annum. The car, on the other hand, will have depreciated by maybe 60% in the same amount of time. So, in three years time you end with a car worth £4,000 when you could have had £12,250 in your savings account. The savings soon worth three times more than the car.

(Obviously, this is just an example and you should remember that going with the savings account instead of the car would have its own opportunity costs.)

The lesson here isn’t that you should never buy anything that will depreciate. Nor is it that you should save everything you earn! However, you should use opportunity costs to look ahead and think about the long term implications of your spending.

]]>