Though all lenders have their own rules, regulations and procedures, the basic concept is always essentially the same: to act as an intermediary between individuals who want to borrow and those happy to lend their money in exchange for a return.

How Is Peer to Peer Lending Different to Traditional Banking?

Of course, the above description of peer to peer lending could also be used to describe the function of a traditional bank, whereby savers place their money in the coffers of the institution who then invest it and share out the returns amongst their customers in the form of interest.

The key difference between peer to peer lending and regular banking is that, with a peer to lender, the money being raised and lent out is not the responsibility of the company arranging the loan. They take a fee for making the arrangement, but do not actually take charge of the money in the same way that a bank does.

This means that they do not have to guarantee deposits for investors and savers and, by the same token, they do not need to worry about the possibility that those receiving the funds might default on their repayments. As they are in a less risky position and have lower operating costs than a bank, they are generally able to offer considerably better returns. For example, Zopa currently offer savers 5.1% or higher whilst most high street banks deem 2% or lower to be competitive.

These higher returns do not come at the expense of borrowers however. Indeed, they also benefit from cheaper rates than are easily available elsewhere. Though the difference is not quite so marked, a loan from a peer to peer lender will generally be cheaper to repay than an equivalent from a bank.

What Are The Risks?

As stated above, the main reason peer to peer lenders are able to offer such good rates to borrowers and savers alike is that they do not offer the same assurances as banks. Such companies are not backed by the Financial Services Compensation Scheme which can help those who lose money to banks that fail.

That said, peer to peer lending is far from an unregulated free for all. Indeed, peer to peer lending services have such stringent controls over how savers’ money is lent out that the biggest names in the field actually have a lower default rate (around 0.5%) than the major banks, with between 75-90% of loan applications turned down on the basis of credit checks and affordability tests.

Moreover, lenders have various other ways of minimising the risk posed to borrowers. For example, they may ensure that your money is split between a high number of lenders (for Zopa it’s at least 50, and no one borrower ever has more than £10 of any single lender’s money) as a provision against any one of them failing to pay back the loan.

In addition, unlike with a bank where savers have no say on how their money is invested, with many peer to peer lenders you are able to choose exactly what sort of borrowers you are happy to give money to according the category of risk they present according to the lender’s assessment. This gives you the option to diversify your investment by spreading your money across different ‘markets’ or risk categories, just as you might with a portfolio of stocks and shares.

Others, such as RateSetter, don’t offer such control but instead allow lenders to make a small contribution to their ‘provision fund’ which is kept in reserve to compensate savers should their money be lost. Though this isn’t legally guaranteed, it has ensured that to date all savers have got back the money have lent, and the interest owed them, in full.

It is worth noting that when your money is waiting to find a lender it will usually be held in a ring-fenced account with a bank and will therefore have protection from FSCS for that time, should the company go under. Furthermore, the big names of the industry have formed the peer-to-peer finance association, which sets out a code of conduct lenders should follow with regards to recovering saver’s money should something go wrong.

Whilst the measures the big peer to peer lenders use to manage risk appear to be highly effective, it’s important to remember that lending still entails some level of risk. As such it would be foolhardy place all you eggs in one basket, and you’d be well advised to use peer to peer lending in conjunction with other methods of saving where returns are absolutely guaranteed.

Accessibility

Whilst the rates on offer are better than those to be had from the average savings account, in some ways the comparison is a little unfair. Whilst the majority of savings accounts allow you to take your money out without any sort of notice period, getting your money out an account with a peer to peer lender can be slightly more convoluted.

In most cases you will choose how long you want your money (or a particular portion) to be locked away for by deciding how long term a loan you’re willing to back. As with a product such as a high interest bond, the longer you’re willing to leave your money in the hands of others the better the rate you’ll be offered.

If you want to access your cash before it’s due to be repaid you can, depending on the service, sell off the debt to somebody else happy to lend on the same terms as you had been. However, there’s usually a charge in the region of around 1% of the sale for this and there may be other restrictions.

That said, Funding Circle (who allocate saver’s money to small businesses) claim that on average a buyer is found for an up for sale loan within half an hour and that funds from sale are usually released within two days.

]]>You can receive this income weekly, monthly or, more commonly, annually. In addition you can withdraw up to 5% of your investment each year. Other than that, unless you are willing to face heavy charges for early withdrawal, you’re expected to leave your sum to mature, and cannot access the rest of the funds until then.

Typically the minimum amount you can place in such bonds is £5,000 with the maximum normally being £1,000,000.

Perhaps the biggest difference with between guaranteed income bonds and savings accounts is the fact that they are purchased from insurance firms rather than banks. However, potential investors should rest assured that these institutions offer the same high level of security you’d expect when placing your money into a regular account. Indeed, the only way your original pot of capital can be eaten into or lost is in the unlikely event of your chosen insurer going bust. Even then you can claim compensation worth up to 90% of your investment.

The other big difference, the one that attracts many high earning savers, is that, due to UK tax laws, savings can be made on the amount of your earnings that will be payable to the inland revenue. This is because all investment bonds are charged at the basic rate of tax (20%). As higher and top level tax payers are supposed to pay 40% and 50% on their incomes respectively, they are taxed again at 20% or 30% depending on which bracket they belong to.

However, unlike with income earned through on an interest account this amount is not ‘grossed up’ before the extra tax is applied. Only the actual income is subject to the extra tax. This leads to a small tax benefit, which, when dealing with large amounts, can save you a considerate amount.

Whilst the flexibility bonds offer can make them more attractive to savings accounts, they only offer their full benefits to top level tax payers. In addition, experts generally warn against investing at a fixed rate of interest over a long period of time as, if the base rate rises, your investment will effectively well you short.

]]>

Game theory is used to by mathematicians to calculate the best course of action to take in various strategic situations. At its most complex game theory can be used, not only by businesses and economists, but also social scientists, psychologists, philosophers and biologists. At its simplest, it’s something we can all make use of in our everyday lives.

What Is Game Theory?

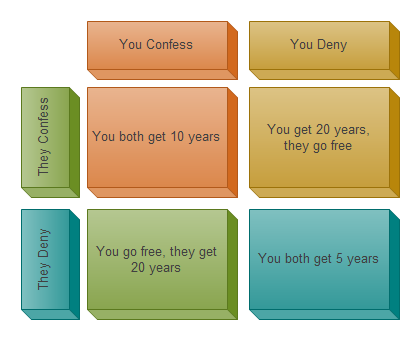

Whilst game theory has many different forms depending on the situation it is applied to, it is easiest to explain by giving a basic example of how it works, such as the well known prisoner’s dilemma;

Imagine that you and a friend have been arrested by the police force of a corrupt government, accused of a joint crime. They are assuming that you are guilty and there will be no trial. Instead, they offer you two options; deny the charges or confess to them.

The possible outcomes of your decision are;

- If you both confess, you’ll both get 10 years in jail.

- If you confess the charges and your friend denies them, he’ll get a full 20 years, but you’ll be rewarded for exposing him by going free (and vice versa.)

- If, even in the face of this offer, you still both deny the charges, they will entertain the idea that you are innocent after all and only give you five years each, just in case.

You are held in separate cells and can’t communicate.

The situation and its possible outcomes can be expressed in a matrix like this;

If you think they will deny, it is best to confess. That way you go free instead of getting 5 years for denying it along with them.

However, even if you think they will confess, it is still better for you to confess as well. That way you’ll only get 10 years, avoiding the 20 years you’d get if you choose to deny the charge.

As, no matter what the other person does, it is better for you to confess, confession is what’s called the ‘dominant’ strategy.

So, with that in mind maybe it’s not a dilemma at all? Surely it is best just to confess, isn’t it?

Nash Equilibrium

This situation is what’s called a ‘Nash equilibrium’ (named after the pioneering mathematician John Nash, played by Russell Crowe in the film ‘A Beautiful Mind’).

In a ‘Nash equilibrium’ one person looks at what the other might do and decides that, as they can’t tell what their choice will be, they have to stick with the option that is safest in all cases. They have to go for the ‘dominant’ strategy. This applies to both prisoners, hence the state of equilibrium.

But is this actually what’s best for the people involved? No, it isn’t!

Why? Look again at the prisoner’s dilemma example above. Because both prisoners will reach that same conclusion that confession is the ‘dominant strategy’ both will confess. That means they both get 10 years in jail.

However, if they both deny they only get 5 years! This is the option that involves the least combined jail time. On top of that the jail time is split fairly between both parties. This makes it what’s called the ‘optimum outcome’. In other words, it’s the best thing that could happen, overall.

But can you trust your partner to figure this out? If you deny and they still confess you’re looking at 20 years!

In real life people, especially when it comes to businesses, tend to see others as competition rather than partners. Therefore, they go for the safe option i.e. the dominant strategy.

The real lesson of ‘Nash equilibrium’ is that, due to not cooperating properly people and businesses usually miss out on the ‘optimum outcome’ because they are scared of straying from the ‘dominant’ option, which guards against the unpredictability of others.

Basically, we could all be better off if we all worked together, but in business that isn’t how it works.

How Do Businesses Use Game Theory?

The way that businesses decide on their pricing structures is very similar to the logic of the prisoner’s dilemma.

When a business sets a pricing strategy it has two basic options;

- Charge as much as possible, making maximum profit from each sale.

- Charge as little as possible, keeping prices down and driving up demand.

These are the two extremes of the scale and all pricing strategies fall between these two poles. But if this is the case, why do similar products generally cost more or less the same? Why don’t we see a wider variety of pricing structures used?

The answer lies with the Nash Equilibrium.

In our earlier example we saw that if each prisoner denied the charge it would produce the ‘optimum outcome’ but that they would also run the risk of going down for 20 years if their partner confessed.

For two similar competing businesses the optimum outcome would be if they both set high prices, as they would make high profits on each sale and, as customers would have little reason to pick one over the other, prices being the same, they would likely have an equal market share.

However, if one business sets its prices at an artificially high level, they have no guarantee that other businesses will do the same. They run the risk of competitors undercutting them.

Should this happen the business with the lower price will take a huge chunk of the market share, as customers will choose the cheaper option. The firm with lower prices will prosper and the firm with high prices will be ruined.

By this logic, if one firm finds itself in a position where it can offer extremely low prices, all the other firms are forced to lower theirs as well, to avoid losing custom. This will eat into their profits and make all the businesses worse off.

(Some businesses have even used this as a tactic to ruin their competition. Some big chain stores have been known to move into an area, lower prices to the point that they are making a negative ROI, forcing others to do the same. The local businesses can only survive making a loss for a while, but the chain store can go on, as it is supported by the profits from other branches. Once all the local competition has been eliminated the chain store puts up its prices, knowing customers have no choices left!)

As a result, competing businesses are held in a sort of ‘Nash equilibrium’ when it comes to pricing, going for a competitive price to avoid being undercut, but also trying to avoid triggering a ‘race to the bottom’ that makes everyone worse off. This is good news for customers as it means they usually get a decent deal.

If the businesses were to get together and cooperate to keep prices high it would be very harmful to consumers. Some businesses attempt to do this, forming cartels and making agreements with each other. In most countries and in most industries this practice of ‘price fixing’ is illegal.

In the same way that the prisoners were held in separate cells to stop them cooperating with each other, government’s encourage businesses to be competitive so that they will not indulge in price fixing.

How Can I use These Ideas to Improve My Personal Finances?

There are a number of ways you can use a good knowledge of game theory to improve your finances. For one thing, simply being aware of how ‘Nash equilibrium’ should keep prices low will help you spot when businesses are not behaving in a competitive manner and avoid getting ripped off.

Sometimes you can even use game theory to save money by forcing businesses into a sort of prisoner’s dilemma which will make them more competitive and thus lower their prices.

For example, one leading thinker in the area of game theory uses this technique whenever he buys a car;

In the morning he will phone every dealership within easy travelling distance of his home. He tells them all the same thing; that he has decided that he will definitely be buying X car that day at 5pm. He will turn up with a cheque at whichever dealership phones back with the best offer in the mean time.

In doing so, he creates a sort of reverse bidding war. As we’ve seen it would be best for all the dealerships involved if they all ignored him, as they wouldn’t have to lower their price. But by now we know that businesses rarely go for the ‘optimum outcome’. Instead, they’ll go for the ‘dominant strategy’ and lower their price to avoid losing an easy sale, assuming the other show rooms are doing the same thing. The gentleman in question claims to have thousands using this method.

Of course sometimes, even though you are a private individual rather than a business you yourself may have to use game theory in an uncooperative manner, for the sake of your personal finances.

For example, if you are bidding on a house game theory can be very useful in helping you decide how much you’d like to bid. If you are competing with another person to get the house the ‘optimum outcome’ as far as you’re concerned would be if you both put in low bids. One of you is going to win the house anyway, so why go crazy?

However, you aren’t going to be discussing your bids with the other interested party (you probably won’t know who they are) and you have to assume that if you go with a low bid they might outbid you. By the same token, if you are desperate to avoid being outbid and put in a higher offer, you may end up paying several thousand pounds more than need be.

In this case you will both go for the middle path, trying to avoid being outbid on the one hand, and paying more than need be on the other. This is the best that you can do, given what others may be doing. In other words, it is the ‘dominant strategy’.

This is especially true if you are buying a house in Scotland, as you will normally make a sealed bid for it. In this case you only get one chance to make a choice on how much to offer and you have no way of knowing what the other interested parties might do. This makes it highly analogous with the prisoner’s dilemma we have been looking at.

In England houses are sold in a slightly different style similar to that of an traditional English auction, where even if the other bidder out bids you, the auctioneer will come back to you and give you the chance to put in a higher offer.

In this instance, the fact that you will get multiple chances to bid and the fact that you will be aware of what your fellow bidders are doing means that it may be easier for you to co-operate and reach an ‘optimum outcome’ by only increasing your bids by a small amount each time.

You can also use you knowledge of game theory to undo the ‘Nash equilibrium’ in situations where you and your friends are going for a ‘dominant strategy’ when you could get an ‘optimum outcome’ instead.

When you think about it, there are a lot of situations that may arise in your social life that are similar to the prisoner’s dilemma.

For example, when you and a group of friends are going out to a social event you, like a business, have to pick a sort of pricing strategy. Do you go somewhere expensive, that will be a really great experience, but maybe a bit expensive for some people in the group, or do you go somewhere that everyone can easily afford, but maybe be less enjoyable?

As people are often embarrassed in discussing matters of personal finance they go for what appears to be the ‘dominant option’ of picking something that is a slight strain on their finances, but that they think everybody else will want to do.

However, unlike businesses and prisoners, there are no rules to stop you and your friends communicating with each other to discover the optimum solution. You may all be worried about suggesting somewhere cheap and risking embarrassment, but if you come out and say it you’ll probably find everyone was thinking the same thing, they just didn’t say so based on what that thought the rest of the group would want. In other words, they were stuck in an unhelpful ‘Nash equilibrium’.

If you know your stuff you can avoid such situations!

]]>How Will Junior ISAs Work?

The main difference between an ISA and any other form of savings account is that the interest accrued is exempt from tax and, whilst children’s savings are protected from tax to an extent, Junior ISAs will now allow you to make completely tax free savings for your child.

This is because Junior ISAs, unlike regular savings accounts, are not subject to ‘the £100 rule’, which states that any interest above a cap of £100 earned by a child’s savings is considered part of the parent’s earnings and taxed accordingly.

Do I Invest Cash or Shares?

Both Cash and Shares based options are available however, one of the biggest advantages of Junior ISAs is that, as children are entitled to one account of each type, you don’t have to choose between them.

This means that, if you are wanting the make the most of the opportunities for profit that the stock market offers, but are worried about tying your investment to the fortunes of the market, you can spread the risk by placing some of your funds in a cash ISA.

Whilst the lack or risk attached to the cash option is attractive (there is no way that your investment can loose value unless inflation rises quicker than the interest rate offered by your ISA provider) it is worth remembering that, traditionally, the value of shares has risen quicker than the rate of inflation. If you do go with a shares option you’ll find that, as the investment is so long term, some of the risk is taken out of the equation and that a poor performance one year can be redeemed over time.

Finally, funds can be switched between the two accounts, allowing you a greater degree of control over your investment.

Who Has Control Over the Account?

Whilst the parents are charged with managing the account and can, for example, move funds from a child’s Junior cash ISA to a shares based option, the extent of their control is limited.

Firstly, once funds have been paid into the account they are ‘locked in’ and cannot be accessed again by anybody other than the child whose name the account is in, and even they can only withdraw money once they reach 18.

Parents are also unable to control how or when their child will be able to access the money. On their 18th birthday the account will automatically become an ordinary ISA and control of it will be handed over to them. As a result they will have full and immediate access to all of the funds in the account.

Who Qualifies for a Junior ISA?

To a large extent Junior ISAs are being introduced as a replacement for Child Trust Funds, a type of government sponsored savings account for children which stopped running in January 2011. As a result only those born later than the 3rd of January will be eligible for a Junior ISA and any child that already has a Child Trust Fund will not be allowed switch over to the new form of account.

Children born before the introduction of Child Trust Funds in September 2002 are the exception to this rule, which is great news as parents whose kids missed out on the CTF era will be now able to have a Junior ISA instead.

Who Can Set Up a Junior ISA?

It is down to the parents rather than the government to set up a Junior ISA and, unlike the Child Trust Funds, the government will not help you to start up the account or contribute funds to it, the exception being looked-after children. (You can find about rules such as these in more details by reading the treasury’s draft regulations.)

Children are also able to set up Junior ISA accounts for themselves once they reach the age of 16.

How Much Can I Pay Into a Junior ISA?

Parents, Grandparents or anybody else with an interest in the child’s future can pay up to a total of £3,600 a year into the account (although it is worth checking here for the latest ISA allowances), a significantly larger figure than the £1,200 that could be paid into a Child Trust Fund. This means that, if you have funds available to invest, more of your child’s nest-egg will be tax exempt than ever before.

Who Has Control Over the Account?

Whilst the parents are charged with managing the account and can, for example, move funds from a child’s Junior cash ISA to a shares based option, the extent of their control is limited.

Firstly, once funds have been paid into the account they are ‘locked in’ and cannot be accessed again by anybody other than the child whose name the account is in, and even they can only withdraw money once they reach 18.

Parents are also unable to control how or when their child will be able to access the money. On their 18th birthday the account will automatically become an ordinary ISA and control of it will be handed over to them. As a result they will have full and immediate access to all of the funds in the account.

Where Will I be Able to Get a Junior ISA?

Junior ISA will be available from November 2011 onward and will be provided by the vast majority of mainstream lenders, such as high-street banks and building societies.

Related Articles

]]>ISAs made easy

ISA simply stands for ‘Individual Savings Account.’

There are two are two types of ISA – Cash ISAs and investment ISAs.

What is a cash ISA?

A cash ISA is like a normal savings account but offers the following key benefits:

- The income you accrue from your cash ISA savings is tax free.

- Interest earned in a cash ISA can be up to six times higher than the bank rate depending on the current promotional offers available to savers.*

- You can opt for an instant access cash ISA, which means you can access your money if you need to at any time.

What is an investment ISA?

An investment ISA is a tax efficient wrapper for your investments which have certain qualifying criteria. (I.e. You must be at least 18 for an investment ISA and resident and ordinarily resident in the UK for tax purposes.)

If you deposit funds in an investment ISA (also known as a stocks and shares ISA), your money will be invested in the stock market.

Investment ISAs are free from capital gains tax and income tax but the tax credit on dividend income received is not reclaimable. Investment ISAs have the potential to outperform cash savings but you need to be aware that, as these ISAs operate within the stock market, their value at any given time can fluctuate as returns depend on the performance of the underlying investments – so you can lose money as well as make money.

Before moving your money, you may want to consult your financial adviser to identify the best ISA deals and investment plan to suit your needs.

Remember, eligibility for ISAs depends on your individual circumstances, and the rules around them – such as their tax treatment – could change in the future.

How much can I invest?

All UK nationals have an annual ISA allowance of £10,200.

- You can put up to £5,100 of your £10,200 annual allowance in a cash ISA.

- You can invest the remainder of your allowance (£5,100) in an investment ISA.

- You can spread your allowance across both cash ISA and an investment ISA. For example, you could put £2,200 in a cash ISA and invest £8000 in shares.

- You are able to invest the full £10,200 in an investment ISA.

- The annual ISA allowance will increase to £10,680 (of which up to £5,340 can be saved in a cash ISA) for the next tax year, which starts on 6 April 2011 and ends on 5 April 2012.

It’s important to think about your attitude to risk before investing in an investment ISA because the returns are not guaranteed, and you may end up with less money than you originally put in because the value of investments can go down as well as up.